For all Budget related news including in depth analysis and detailed information, click here

Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas

WTI March prices have buoyed higher in Asia and kept the momentum stronger at the start of European session to trade up 0.5% at $79.28/barrel, following 2% decline on Tuesday, amid demand slowdown worries from Eurozone and US on poor economic data.

The German retail sales dip by5.3% in Dec, while the US Chicago PMI was softer at 44.3, which drifted dxy to finish lower at 102.10. API crude inventory forecast showed yet another build-up in US weekly oil reserves across the product line, trader should remain cautious ahead of the EIA data as another build up in inventory would 4th weekly inventory gains and that could trigger a selloff in oil prices. The Lower ISM mfg. numbers could also weigh on oil prices. The key focus of market remains on the outcome of US FOMC.

We expect oil prices to drift lower as European and US economic numbers are showing slowdown concerns.

Nifty metal index sheds 3.5 percent dragged by Adani Enterprises, Hindustan Copper, Welspun Corp

Srikanth Subramanian, CEO, Kotak Cherry

The Union Budget was pragmatic, considering that the government has a tight rope between managing fiscal deficit and giving some relief to residents from high inflation. Higher capex spend, road-map to reduce fiscal deficit and boosting consumption will provide a major leg-up to the economy, especially at a time when the global growth has been hit hard by slowdown and recessionary fears.

Finally, the overhauling of the income tax structure should add more money into the hands of the middle-class taxpayers that would give a boost to consumption and increased allocation towards several investment options. Overall it would leave more people with extra money in their hands and a smile on their faces.”

Market at 3 PM

Benchmark indices erased all the intraday gains and trading lower with Nifty around 17500.

The Sensex was down 210 points or 0.35% at 59,339.90, and the Nifty was down 170.20 points or 0.96% at 17,492. About 993 shares have advanced, 2288 shares declined, and 95 shares are unchanged.

Adani Group stocks under pressure as Credit Suisse halts margin loans on Adani bonds

Adani Group stocks came under pressure again on February 1 with stocks locked at lower circuits.

Adani Green Energy Limited was quoting at Rs 1,114.00, down Rs 110.05, or 8.99 percent Adani Total Gas was quoting at Rs 1,901.65, down Rs 211.25, or 10.00 percent.

Adani Enterprises was quoting at Rs 2,231.25, down Rs 743.75, or 25.00 percent Adani Power was quoting at Rs 212.75, down Rs 11.15, or 4.98 percent.

Adani Transmission was quoting at Rs 1,680.00, down Rs 93.95, or 5.30 percent and Adani Wilmar was quoting at Rs 443.60, down Rs 23.30, or 4.99 percent.

Adani Ports and Special Economic Zone touched 52-week low of Rs 490.25 and quoting at Rs 490.25, down Rs 122.55, or 20 percent.

As per Bloomberg, Credit Suisse Group AG has stopped accepting bonds of Gautam Adani’s group of companies as collateral for margin loans to its private banking clients, a sign that scrutiny of the Indian tycoon’s finances is growing after allegations of fraud by short seller Hindenburg Research.

Rakeshh Mehta, Chairman, Mehta Equities

Keeping India and its citizens first, it was a well-presented growth-oriented budget with a focus to build India’s economy much stronger. At a macro level, increase in capital investment outlay by 33% to Rs 10 lakh crore — 3.3 percent of the GDP, would propel the economy towards a high growth trajectory, which is the need of the nation.

From the individual perspective, huge income tax relief with a hike in tax slab structure would bring more money into the hands of the tax-payers that should help drive consumption growth over the long term.

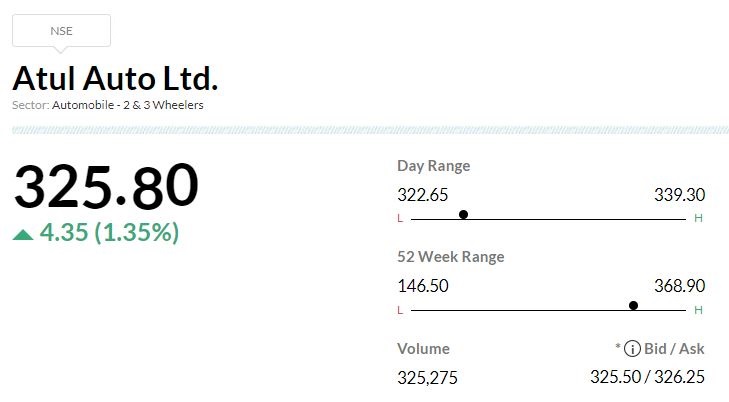

Atul Auto January auto sales | Total sales were up 27.68% at 2,205 units against 1,727 units, YoY.

TVS Motor January total sales up 3% at 275,115 unitsTVS Motor Company registered a sales growth of 3% with sales increasing from 266,788 units in the month of January 2022 to 275,115 units in January 2023

Dhiraj Relli, MD & CEO, HDFC Securities

It was a delight to hear the Finance Minister presenting the budget that painted vibrant colours on the India growth story canvas.

The last full Budget by the NDA Govt was not populist as some feared, but continued on the path of fiscal prudence with minimal changes in tax proposals reflecting the Govt.’s thrust on stability in tax regime. While the nudge to new tax regime has gained momentum offering reliefs for those who opt for it, HNIs are impacted both ways – reduction in peak surcharge rate benefitting them while Capital gains and MLD limits could hurt them to an extent. Real estate companies in the affordable segment could benefit while those in ultra high value segment could get impacted.

Increase in capital expenditure and on Railway capex is a welcome measure that could trigger a lot of other investments by the private sector and stimulate income growth. Including payments to MSME u/s 43B could be an irritant to large businesses and may have unintended consequences. Bond street is relieved immediately due to borrowing estimates coming within expected levels. Stock markets have reacted well to the provisions immediately due to absence of any major unexpected negatives and adherence to fiscal prudence. The markets will now look forward to the other triggers for moving from now on – the US Fed meet outcome, RBI MPC meet outcome and the balance Q3 corporate results.

In a nutshell, I would state this budget to be prudent, progressive and pragmatic.

| Company | CMP | High Low | Fall from Day’s High |

|---|---|---|---|

| TCS | 3,390.55 | 3,394.20 3,355.00 | -0.11% |

Wipro401.40 403.90

399.55-0.62%