One97 Communications-owned Paytm will launch its initial public offering for subscription in the coming week. This is the largest-ever public issue in the history of Indian capital markets. Before this, state-run coal mining company Coal India had the biggest IPO of more than Rs 15,000 crore in October 2010.

Here are 10 key things to know before subscribing Paytm public issue:

1) IPO Dates

The offer will open for investors on November 8 and it will close on November 10.

2) Price Band

The price band for the offer has been fixed at Rs 2,080 to Rs 2,150 per equity share.

3) Offer Details

Paytm is planning to mobilise Rs 18,300 crore through its public issue that comprises a fresh issue of Rs 8,300 crore and an offer for sale of Rs 10,000 crore by selling shareholders including founder and investors.

Founder Vijay Shekhar Sharma will sell Rs 402.65 crore worth of shares through OFS. Among investors, Antfin (Netherlands) Holding B.V. will sell up to Rs 4,704.43 crore worth of shares, Alibaba.com Singapore E-Commerce will offload Rs 784.82 crore of shares, SVF Panther (Cayman) Rs 1,689.03 crore, and BH International Holdings will sell Rs 301.77 crore worth of shares via OFS.

Elevation Capital V FII Holdings and Elevation Capital V are going to offload Rs 75.02 crore and Rs 64.01 crore worth of shares, while SAIF III Mauritius Company, and SAIF Partners India IV will sell Rs 1,327.65 crore and Rs 563.63 crore worth of shares via OFS.

Other selling shareholders – Mountain Capital Fund L.P., RNT Associates, DG PTM LP, Ravi Datla, Amit Khanna, Prakhar Srivastava, Saurabh Sharma, Manas Bisht, Sanjay S Wadhwa, SasiRaman Venkatesan, N Ramkumar and Abhay Sharma – will offload Rs 86.98 crore of shares.

The company already garnered Rs 8,235 crore from anchor investors on November 3, including Blackrock, CPPIB, Birla MF, GIC among other blue-chip investors.

4) Objectives of Issue

The payment services provider is going to utilise net proceeds from its fresh issue for growing and strengthening Paytm ecosystem, including through acquisition and retention of consumers and merchants and providing them with greater access to technology and financial services (Rs 4,300 crore).

The fresh issue funds will also be used for new business initiatives, acquisitions and strategic partnerships (Rs 2,000 crore), besides general corporate purposes.

Also read – After a record Samvat 2077, IPOs may mop up over Rs 1 lakh crore next year, say analysts

The offer for sale money will go to selling shareholders.

5) Lot Size and Investors’ Reserved Portion

The minimum bid lot size has been fixed as 6 equity shares and in multiples of 6 shares thereafter. Hence, retail investors can invest a minimum of Rs 12,900 for a single lot and their maximum investment would be Rs 1,93,500 for 15 lots.

Up to 75 percent of the offer is reserved for qualified institutional buyers, 15 percent for non-institutional investors, and the remaining 10 percent is for retail investors.

6) Company Profile & Industry

Incorporated in 2000, One97 Communications launched Paytm in 2009, the India’s leading digital ecosystem for consumers and merchants. It is a ‘mobile-first’ digital payments platform to enable cashless payments for Indians. It is the largest payments platform in India based on the number of consumers, merchants, transactions and revenue as of March 2021, according to RedSeer.

Also read – Paytm or Sapphire Foods IPO – which issue should you invest in?

The company offered payment services, commerce and cloud services, and financial services to 337 million registered consumers and over 21.8 million registered merchants, as of June 2021.

It provides consumers a wide selection of payment options on the Paytm app including Paytm payment instruments (which allow them to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later and wealth management accounts), and major third-party instruments (such as debit and credit cards and net banking). The company also helps merchants to acquire and retain customers, and create demand, by offering services like selling tickets to customers, advertising, mini-app listings, channel and loyalty solutions.

Digital payments in India has been evolving rapidly. Unique online transacting users, transacting for services such as online banking, mobile top-ups, in-store payments etc. are expected to grow from 250-300 million in FY21 to 700-750 million by FY26.

With increasing smartphone penetration and internet usage, and the proliferation of digital products and services for consumers, India’s digital ecosystem is at an inflection point. Overall digital commerce (including e-commerce, e-recharges and bill payments) in India is expected to grow over 3.3 times in the next five years to more than $300 billion in FY26 from approximately $90 billion in FY21, according to RedSeer.

Also read – Subscribe to One 97 Communications, says Choice Equity Broking

7) Financials

Paytm is the largest payments platform in India with a gross merchandise value (GMV) of Rs 4,03,300 crore in FY21 against Rs 3,03,200 crore in FY20, having mobile payments transaction volume market share of approximately 40 percent, and wallet payments transaction market share of 65-70 percent. The gross merchandise value increased to Rs 1,46,900 crore in Q1FY22 from Rs 69,700 crore in Q1FY21.

The company posted consolidated loss of Rs 1,701 crore in the financial year FY21, which has been narrowing from loss of Rs 2,942.4 crore in FY20 and loss of Rs 4,230.9 crore in FY19. Revenue from operations in the said periods stood at Rs 2,802.4 crore against Rs 3,280.8 crore and Rs 3,232 crore respectively.

Loss in the quarter ended June 2021 stood at Rs 381.9 crore against loss of Rs 284.4 crore in the corresponding period last fiscal. Revenue in the same period jumped to Rs 890.8 crore from Rs 551.2 crore YoY.

Payment and financial services segment contributed to Rs 2,109.2 crore to revenue from operations in FY21 against Rs 1,906.8 crore in FY20, and the same contribution in Q1FY22 at Rs 689.4 crore increased from Rs 429.8 crore in Q1FY21.

Commerce and cloud services vertical accounted for Rs 693.2 crore to total revenue from operations in FY21, against Rs 1,118.8 crore in FY20 and same in Q1FY22 increased to Rs 201.4 crore from Rs 121.4 crore in Q1FY21.

8) Key Risks

KRChoksey Research says there are two risks regulatory and execution, which investors have to consider before subscribing the public issue.

“Company comes under purview of 3 financial regulators viz RBI, SEBI and IRDA. Any unfavorable move by any of the regulator which can act as a barrier to revenue growth can materially impact the valuation. Any delay in execution in any of the business segment can potentially impact the valuation negatively as best case scenario is already priced in,” the brokerage explained.

Marwadi Financial Services also highlighted two risks – if company fails to retain the consumers, attract new consumers, expand the volume of transactions from consumers, its business, revenue, profitability and growth may be harmed. And failure to maintain or improve the technology infrastructure could harm the business and prospects.

“Extremely competitive markets with continuously evolving technology, and dependency on payment services for majority of revenue are two key risks,” said ICICI Direct.

9) Promoters and Management

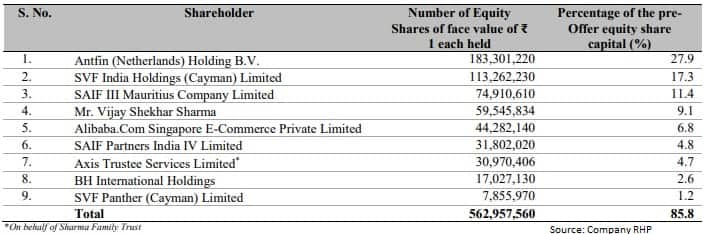

One 97 is a professionally managed company and so does not have an identifiable promoter. Antfin (Netherlands) Holding B.V. is the largest shareholder in the company with 27.9 percent stake, followed by SVF India Holdings (Cayman) with 17.3 percent stake, SAIF III Mauritius Company (11.4 percent), founder Vijay Shekhar Sharma (9.1 percent), and Alibaba.Com Singapore E-Commerce (6.8 percent).

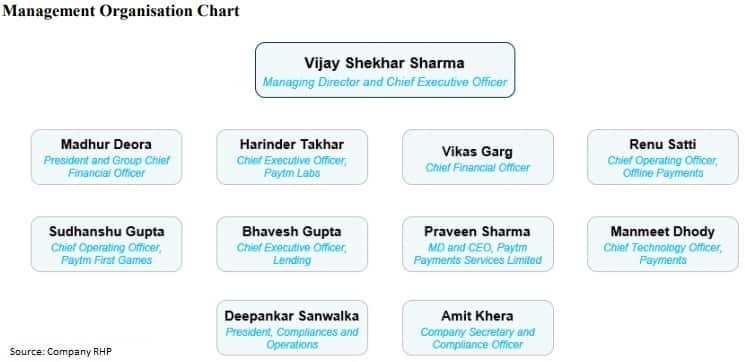

Vijay Shekhar Sharma is the Managing Director and Chief Executive Officer of the company, and the Chairman of the board. Douglas Feagin is the Non-Executive Director (nominee of Antfin (Netherlands) Holding B.V.).

Munish Varma is the Non-Executive Director (nominee of SVF), and Ravi Chandra Adusumalli is the Non-Executive Director (nominee of SAIF and Elevation Capital, collectively).

Mark Schwartz, Pallavi Shardul Shroff, Ashit Lilani, and Neeraj Arora are Independent Directors on the board.

10) GMP, Listing & Allotment Date

Paytm is available at a price of Rs 2,300 in the grey market, a premium of Rs 150 or 7 percent over upper price band of Rs 2,150 per share, as per the IPO Watch.

The share allotment will get finalised by November 15 and then the funds will be refunded to unsuccessful investors by November 16. Eligible investors will receive shares in their demat accounts by November 17.

The trading in equity shares on the BSE and NSE will commence with effect from November 18.

Morgan Stanley India Company, Goldman Sachs (India) Securities, Axis Capital, ICICI Securities, JP Morgan India, Citigroup Global Markets India, and HDFC Bank are the book running lead managers to the issue. Link Intime India is the registrar to the offer.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.