Highlights

– PIF buys a 2.32 percent stake in Jio Platforms for Rs 11,367 crore

– Jio Platforms has raised Rs 1,15,693.95 crore from global investors so far

– Successful completion of rights issue attests to investors’ confidence

– Stake sale accelerates RIL deleveraging efforts; on track to become a zero debt company

——————————————————–After the announcement of the latest deal with The Public Investment Fund (PIF), one of the world’s largest sovereign wealth funds, Jio Platforms has raised a total amount of Rs 1,15,693.95 crore. This is the eleventh bulge-bracket investment in the Reliance Industries Ltd (RIL) subsidiary in less than nine weeks.

Jio has now attracted investments from a variety of global investors ranging from a global network media leader, private equity giant, growth equity firm, leading global investment firm and sovereign wealth funds. Not only does this reassert Jio’s potential transformation as a technology biggie in the eyes of global investors, it also helps in RIL’s goal of reaching its net zero debt goal at a faster clip.

PIF has picked up a 2.32 percent stake for Rs 11,367 crore in Jio Platforms. This assigns an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore, the same valuation as other recent deals.

related news

Successful completion of rights issue

Meanwhile, RIL has also completed its mega rights issue of Rs 53,124 crore, which closed with an oversubscription of nearly 1.6 times. The offer document for the rights issue said about three quarters of the inflows would be used for repaying debt. That would mean, Rs 39,755 crore would go towards repayment/ prepayment of borrowings.

Also read: Rights entitlements trade at premium

De-leveraging accelerates

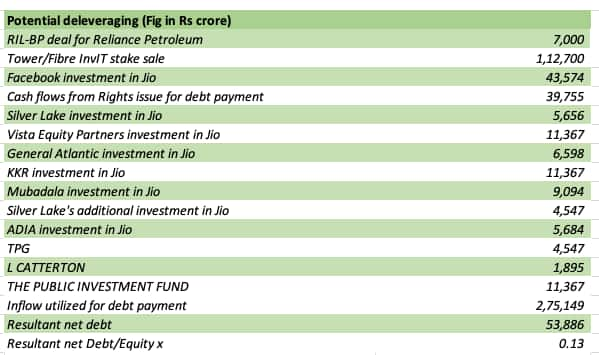

The PIF deal will accelerate the deleveraging efforts. During the recent quarterly result announcements, the company management said that in the current quarter (Q1 FY21), it should be able to raise Rs 104,000 crore on account of the rights issue, the Facebook investment and an earlier investment by BP.

Deals from ADIA, Mubadala, KKR, General Atlantic, Silver Lake, Vista Equity Partners, TPG, L CATTERTON and PIF add additional Rs 60,753.33 crore to the projected cash flows.

In such a scenario, even if we don’t account for the Aramco deal (i.e. the sale of a 20 percent stake in the oil/petrochem business), RIL’s debt to equity ratio should fall sharply.

Also read: Reliance’s rights issue: Shot in the arm for debt reduction efforts

What it means for investors

Assuming no further re-rating of Jio Platforms beyond today’s deal valuation, a modest valuation of the retail business at a 50 percent discount to Amazon’s valuation, a bear case valuation of the legacy refinery and petrochemical business and net debt without considering the possible Saudi Aramco deal, we arrive at a market capitalisation of more than Rs 12.32 lakh crore. RIL’s market price was Rs 1,662 at close of trading on 18 June and its market capitalisation stood at Rs 10.80 lakh crore.

We believe that the implied valuation from the SOTP exercise to be a conservative estimate, given the growth potential of Jio Platforms in the context of the COVID-19 crisis which would accelerate technology adoption.

The premium valuation given by recent investment deals by marquee investors indicates that there is a significant growth potential in the business in the near future.

Disclaimer: Reliance Industries Ltd., which also owns Jio, is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Moneycontrol Ready Reckoner

Now that payment deadlines have been relaxed due to COVID-19, the Moneycontrol Ready Reckoner will help keep your date with insurance premiums, tax-saving investments and EMIs, among others.

Special Offer: Subscribe to Moneycontrol PRO at ₹1 per day for the first year. Coupon code: PRO365. Offer available on desktop & android only. *T&C Apply