Market surged more than 1 percent in the week ended September 17 helped by the positive macro data points and government reforms, which helped indices to hit all-time highs.

Indian benchmark indices, Sensex and Nifty, touched their fresh record high levels of 59,737.32 and 17,792.95 on September 17, respectively.

However, for the week, BSE Sensex added 710.82 points (1.21 percent) to close at 59,015.89, while the Nifty50 rose 215.95 points (1.24 percent) to end at 17,585.2 levels.

The broader indices performed in-line with key indices as BSE Mid, Small and Large-cap indices added over 1 percent each in the week gone by.

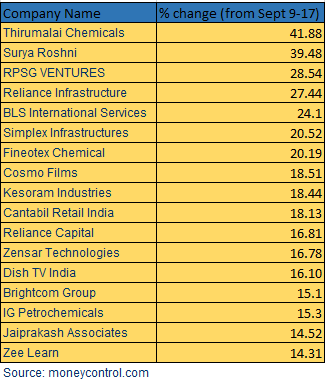

Among smallcaps, 50 stocks gained 10-41 percent each. These include Thirumalai Chemicals, Surya Roshni, RPSG Ventures, Reliance Infrastructure, BLS International Services, Simplex Infrastructures, Fineotex Chemical, Cosmo Films, Kesoram Industries and Cantabil Retail India.

However, Ajmera Realty and Infra India, Walchandnagar Industries, Liberty Shoes and Soril Infra Resources fell 10-17 percent each.

“The Indian market had an attractive week adding investor wealth as both the headline indices traded at its record highs though the bull run was hindered by profit booking towards the end,” said Vinod Nair, Head of Research at Geojit Financial Services.

“Positive economic data and government reforms in telecom, banking and automobile sectors helped in boosting market sentiments.”

“The banking sector that failed to participate in the recent market movement led this week’s rally due to its increased traction,” Nair added.

Also, BSE 500 index added over 1 percent led by the Zee Entertainment Enterprises, Vodafone Idea, IRCTC, Zensar Technologies, Dish TV India, JSW Energy and Interglobe Aviation.

“Markets continued their upward trajectory on expectations of strong medium-term growth and abating inflation risks. Benchmark indices – Sensex 30 and Nifty 50 gained ~1.5%, recording new all-time highs during the week. After witnessing a brief halt last month, BSE Midcap and BSE Smallcap resumed their upward journey,’ said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

“The majority of the sectoral indices remained in the green. BSE Bankex and BSE Auto outperformed the broader markets with gains of ~3% during the week,” he added.

Where is Nifty50 headed?

Samco Research:

Investors across the world will be eyeing the FOMC meeting in the coming week for more clarity on the outlook for both tapering as well as interest rate timelines. While the Fed’s planned reduction of bond purchases has garnered much of the focus this year, their view on interest rates may give new information that may move markets world over.

However, it is widely assumed that policymakers would take fresh developments in inflation and the intensity of the delta variant into account before announcing tapering plans. Therefore, traders are suggested to refrain from taking aggressive bets owing to probability of unanticipated whipsaw movements.

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index closed a week at 17586 with gains of more than one percent and formed a bullish candle on the weekly chart.

Any break below 17,530 zone, we may see more drag down the index, immediate support is still placed at 17,500 followed by 17,430 zone & resistance is coming near 17,650-17,750 zone, also profit booking is suggested around mention hurdle zones.

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

The markets resisted at the 17750 level and what followed was a knee jerk reaction. The trend continues to remain positive and intra-day drops or price corrections can be used to accumulate long positions.

The near term support for the Nifty is at 17,300. If we get past 17,800 the next level to watch out for would be 17,950.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.