The market rebounded on January 7 after losing a percent in the previous session, backed by banks, oil and gas, select FMCG and IT stocks, while the broader markets gained too, with the Nifty Midcap 100 and Smallcap 100 indices rising half-a-percent and 0.4 percent, respectively.

On Friday, the BSE Sensex rallied 142.81 points to 59,744.65, while the Nifty50 climbed 66.80 points to 17,812.70 and formed Doji kind of pattern on the daily charts, while there was bullish candle formation on the weekly scale. The index gained 2.6 percent during the week.

“Albeit the Nifty50 signed off the week with a decent bullish candle on the weekly charts, it is registering indecisive formations on a daily chart hinting that it is in the process of chalking out a consolidation zone between 17,944 and 17,655 levels,” said Mazhar Mohammad, Chief Strategist – Technical Research and Trading Advisory at Chartviewindia.

Going forward, he said, to retain the positive bias, the index needs to sustain above the 17,655 levels and strength shall arise only on a close above the 17,944 levels. “In such a scenario, an upswing can expand into the zone of 18,165 to 18,210 levels.”

Contrary to this, a close below 17,655 can drag down the index towards 17,400 levels where 50-day moving average is present, he said.

Therefore, Mazhar Mohammad advised short-term traders to wait for a directional move to emerge and trade in the direction of the breakout.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,709.87, followed by 17,607.03. If the index moves up, the key resistance levels to watch out for are 17,910.27 and 18,007.83.

Nifty Bank

The Nifty Bank rallied 249.30 points to close at 37,739.60 on January 7. The important pivot level, which will act as crucial support for the index, is placed at 37,399.97, followed by 37,060.34. On the upside, key resistance levels are placed at 38,107.07 and 38,474.53 levels.

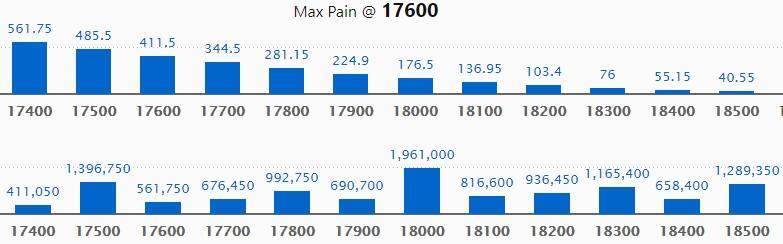

Call Option Data

Maximum Call open interest of 19.61 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 17,500 strike, which holds 13.96 lakh contracts, and 18,500 strike, which has accumulated 12.89 lakh contracts.

Call writing was seen at 18,300 strike, which added 4.47 lakh contracts, followed by 17,900 strike which added 1.86 lakh contracts, and 18,500 strike which added 1.04 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 1.18 lakh contracts, followed by 17,700 strike which shed 1.15 lakh contracts and 17,500 strike which shed 71,700 contracts.

Put Option Data

Maximum Put open interest of 34.11 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the January series.

This is followed by 17,500 strike, which holds 31.23 lakh contracts, and 17,200 strike, which has accumulated 15.47 lakh contracts.

Put writing was seen at 17,800 strike, which added 2.92 lakh contracts, followed by 17,900 strike, which added 92,600 contracts, and 17,600 strike which added 64,450 contracts.

Put unwinding was seen at 17,700 strike, which shed 44,800 contracts, followed by 17,300 strike which shed 30,050 contracts, and 17,200 strike which shed 12,350 contracts.

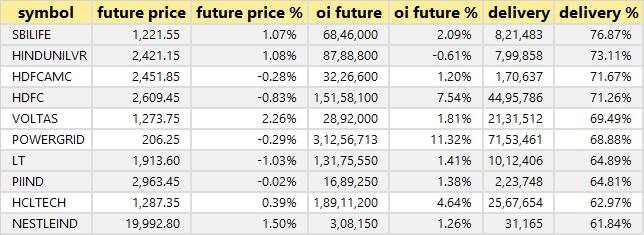

Stocks with High Delivery Percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

54 Stocks Saw Long Build-up

An increase in open interest, along with an increase in price, mostly indicate a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

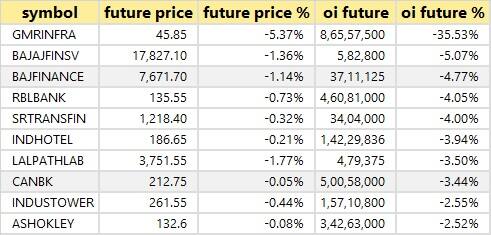

33 Stocks Saw Long Unwinding

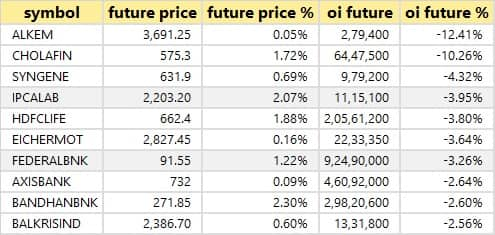

A decline in open interest, along with a decrease in price, mostly indicate a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

58 Stocks Saw Short Build-up

An increase in open interest, along with a decrease in price, mostly indicate a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

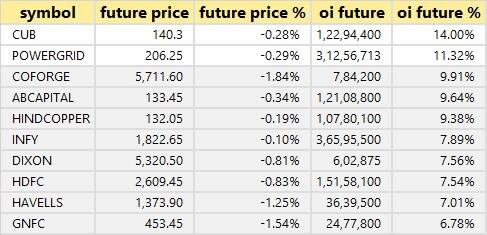

54 Stocks Witnessed Short-covering

A decrease in open interest, along with an increase in price, mostly indicate a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

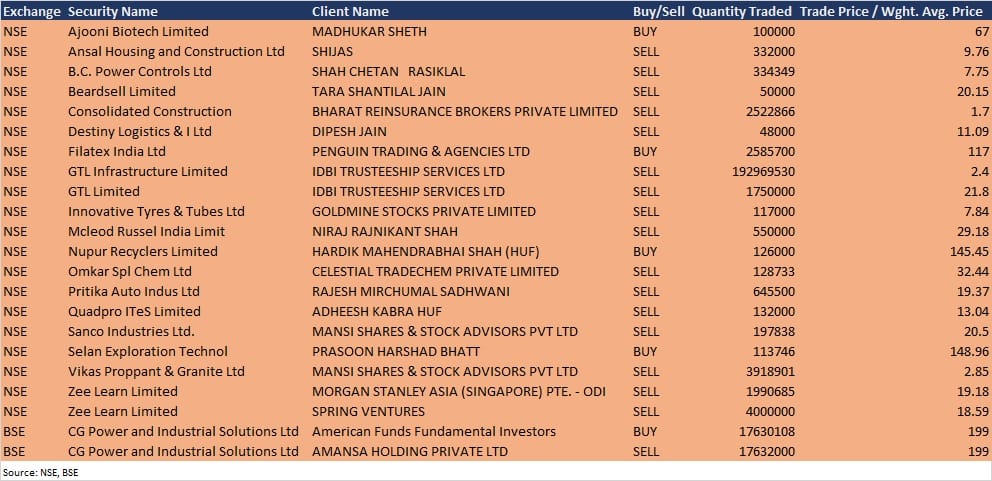

Bulk Deals

Zee Learn: Morgan Stanley Asia (Singapore) Pte – ODI sold 19,90,685 equity shares in the company at Rs 19.18 per share, however, Spring Ventures sold 40 lakh shares at Rs 18.59 per share on the NSE, the bulk deals data showed.

CG Power and Industrial Solutions; American Funds Fundamental Investors acquired 1,76,30,108 equity shares in the company at Rs 199 per share, however, Amansa Holding Private Ltd sold 1,76,32,000 equity shares at Rs 199 per share on the NSE, the bulk deals data showed.

Filatex India: Penguin Trading & Agencies bought 25,85,700 equity shares in the company at Rs 117 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting; and Results on January 10

Results on January 10: 5paisa Capital, Ganga Papers India, GI Engineering Solutions, GNA Axles, Thambbi Modern Spinning Mills, and Vikas Lifecare will release their quarterly earnings on January 10.

Globus Spirits: The company’s officials will interact with Unifi Capital on January 10.

Sobha: The company’s officials will meet analysts and institutional investors on January 11.

5paisa Capital: The company’s officials will meet analysts on January 11, to discuss financial results.

Nippon Life India Asset Management: The company’s officials will meet analysts on January 27, to discuss financial results.

Stocks in News

Tata Steel: The company increased stake in Medica TS Hospital (MTSHPL), a joint venture company, from 26 percent to 51 percent.

Gulshan Polyols: The company has received, signed and executed a Long Term Offtake Agreement, for setting up of upcoming standalone dedicated ethanol plant of 250 KLPD at Industrial Growth Centre, Matia, Goalpara and 500 KLPD (kiloliters per day) at MPAKVN Industrial Area, Borgaon, Madhya Pradesh.

Dilip Buildcon: Subsidiary Sannur Bikarnakette Highways Private Limited has received the financial closure letter from the National Highways Authority of India, for four Laning of Sannur to Bikarnakette section of NH-769 under Bharathmala Pariyojana on Hybrid Annuity Mode in Karnataka.

Sobha: The company reported sales volume of 13,22,684 square feet of super built-up area valued at Rs 1,047.5 crore in Q3FY22, up from sales volume of 11,33,574 square feet of super built-up area valued at Rs 887.6 crore in Q3FY21. Sobha share of sale value stood at Rs 908.2 crore during the quarter, up from Rs 677.7 crore in same quarter last year.

Cyient: Aditya Birla Sun Life AMC sold 21.16 lakh equity shares in the company via open market transactions on January 6, reducing shareholding to 33.93 lakh shares from 56.1 lakh shares earlier.

Avenue Supermarts: The company reported 24.6 percent higher standalone profit at Rs 586 crore, and 22 percent higher revenue at Rs 9,065 crore in Q3FY22, YoY.

CSB Bank: C VR Rajendran decided to take early retirement from the post of MD & CEO and to continue leading the bank till March 31, 2022.

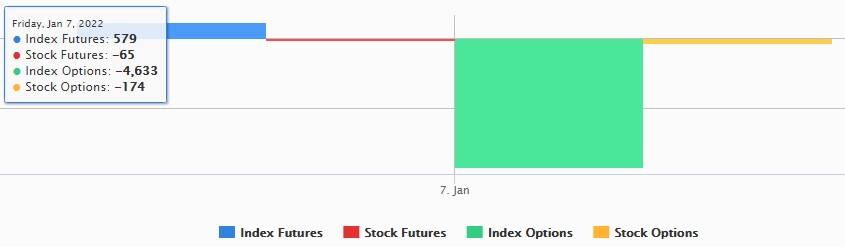

Fund Flow

FII and DII Data

Foreign institutional investors (FIIs) net bought shares worth Rs 496.27 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 115.66 crore in the Indian equity market on January 7, as per provisional data available on the NSE.

Stocks under F&O Ban on NSE

Two stocks – Delta Corp and RBL Bank – are under the F&O ban for January 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.