Benchmark indices snapped their five-day winning streak to end lower on July 22 led by a spike in US-China tensions and surge in coronavirus infections globally.

The Sensex ended the day 59 points, or 0.16 percent, lower at 37,871.52 and the Nifty closed 30 points, or 0.27 percent, lower at 11,132.60.

The Nifty formed a bearish candle on the daily scale, although it has been respecting its rising support trend line and holding above its 200-day Exponential Moving Average (EMA).

“The index can consolidate between 11,250 and 11,300 for a few days. We would advise investors to continue with their defensive portfolio approach given the high valuations and maintain a stock-specific approach. Traders on the other hand are advised to stay cautious and keep on booking profit at regular intervals,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services.

related news

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,046.7, followed by 10,960.8. If the index moves up, the key resistance levels to watch out for are 11,228.3 and 11,324.

Nifty Bank

The Nifty Bank index ended 0.44 percent higher at 22,882.60 on July 22. The important pivot level, which will act as crucial support for the index, is placed at 22,623.43, followed by 22,364.27. On the upside, key resistance levels are placed at 23,176.54 and 23,470.47.

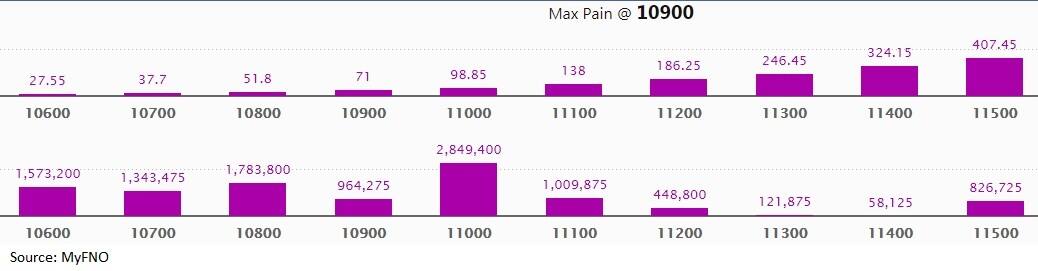

Call option data

Maximum call OI of 31.66 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the July series.

This is followed by 11,000, which holds 22.24 lakh contracts, and 11,200 strikes, which has accumulated 14.33 lakh contracts.

Significant call writing was seen at 11,200, which added 3.16 lakh contracts, followed by 11,500 strikes, which added 2.83 lakh contracts.

Call unwinding was seen at 10,900, which shed 67,500 contracts, followed by 10,700, which shed 33,075 contracts and 10,800 strikes, which shed 22,500 contracts.

Put option data

Maximum put OI of 28.49 lakh contracts was seen at 11,000 strike, which will act as crucial support in the July series.

This is followed by 10,800, which holds nearly 17.84 lakh contracts, and 10,600 strikes, which has accumulated 15.73 lakh contracts.

Significant put writing was seen at 11,000, which added 4.24 lakh contracts, followed by 11,100 strikes, which added 3.24 lakh contracts.

Put unwinding was seen at 10,800, which shed 1.38 lakh contracts, followed by 10,600, which shed 59,325 contracts and 10,900 strikes, which shed 55,275 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

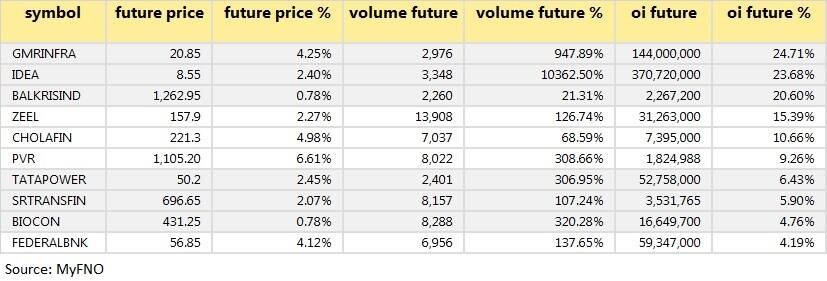

26 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

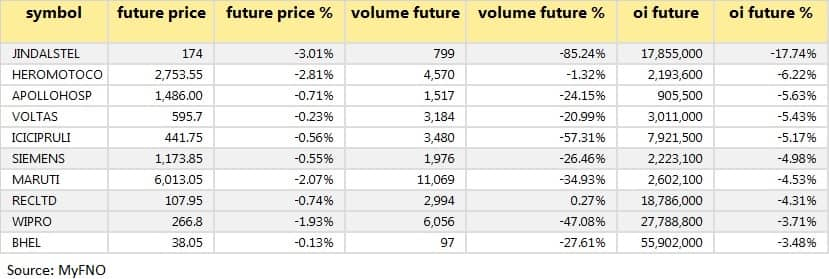

49 stocks saw long unwinding

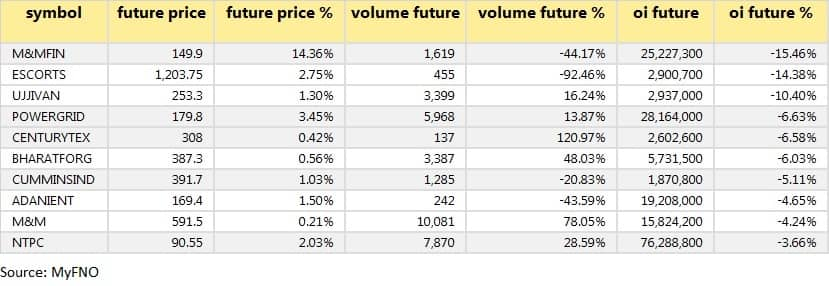

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

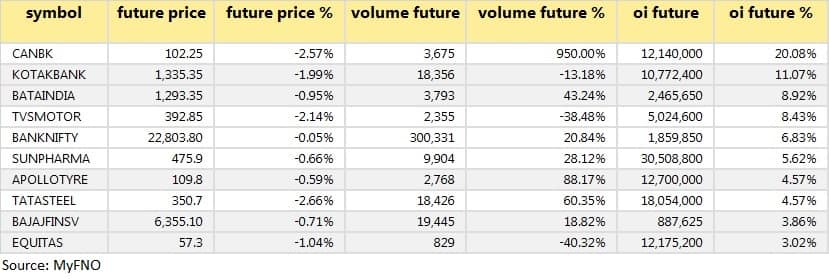

41 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

27 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

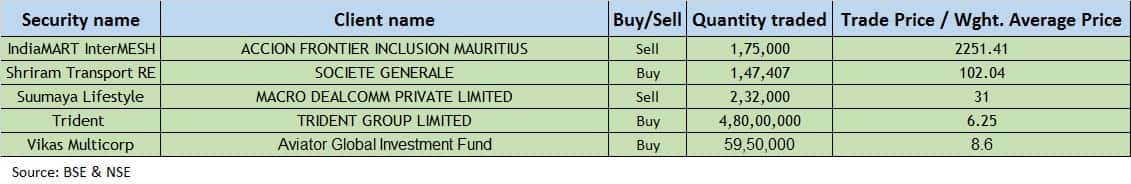

Bulk deals (For more bulk deals, click here)Results on July 23

(For more bulk deals, click here)Results on July 23

ABB India, Biocon, HDFC Asset Management Company, Alankit, Agro Tech Foods, AU Small Finance Bank, Dish TV, Foseco India, Bank of Maharashtra, Mahindra EPC Irrigation, Mphasis, PNB Housing Finance, Radico Khaitan, Repco Home Finance, SKF India, Speciality Restaurants, Sterlite Technologies, Tube Investments of India, Zensar Technologies, etc.

Stocks in the news

Larsen & Toubro: Q1 profit at Rs 303 crore versus Rs 1,472.6 crore, revenue at Rs 21,260 crore versus Rs 29,636 crore YoY.

Vodafone Idea: The Supreme Court dismissed a plea by the Income Tax Department challenging a Bombay High Court order directing refund of Rs 833 crore and upheld Vodafone’s claims for refund of Rs 833 crore for assessment year 2014-15, CNBC-TV18 reported.

Rallis India: Q1 profit at Rs 91.9 crore versus Rs 60.4 crore, revenue at Rs 662.7 crore versus Rs 623.2 crore YoY.

Glenmark Pharma announced Phase-3 clinical trial results of Favipiravir in mild-to-moderate COVID-19 patients.

Heidelbergcement: Q1 profit at Rs 48.9 crore versus Rs 79 crore, revenue at Rs 407.7 crore versus Rs 589.2 crore YoY.

International Combustion resumed operations at the Aurangabad plant.

Satin Creditcare Network: Meeting is scheduled for July 25 for issuance of non-convertible debentures (NCDs) up to Rs 25 crore through private placement.

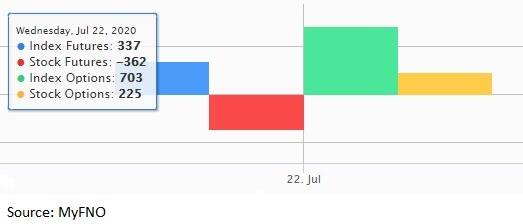

Fund flow FII and DII dataForeign institutional investors (FIIs) bought shares worth Rs 1,665.57 crore, while domestic institutional investors (DIIs) sold shares worth Rs 1,138.83 crore in the Indian equity market on July 22, provisional data available on the NSE showed.

FII and DII dataForeign institutional investors (FIIs) bought shares worth Rs 1,665.57 crore, while domestic institutional investors (DIIs) sold shares worth Rs 1,138.83 crore in the Indian equity market on July 22, provisional data available on the NSE showed.