Follow our LIVE blog for the latest updates on the Russia-Ukraine and its impact

Mohit Nigam, Head – PMS, Hem Securities:

Even though oil prices surged due to a US import embargo on Russian oil, Indian benchmark indices were off to a strong start today. Buying was seen across the BSE sectoral front, with stocks from the Energy, TECK, and IT counters attracting the most attention.

The general market breadth is in favor of increase today. European markets rebounded as buyers bought stocks that had been battered in the recent market selloff. After Ukrainian President Zelenskyy announced the country was no longer interested in NATO membership, investors bought beaten-down shares in the hopes of de-escalating the Russia-Ukraine war.

Net domestic positive flows are currently sustaining the enormous withdrawals observed by FIIs on a daily basis. The robust SIP flow of 11k crore monthly, which continues to expand, accounts for a substantial portion of the positive flows.

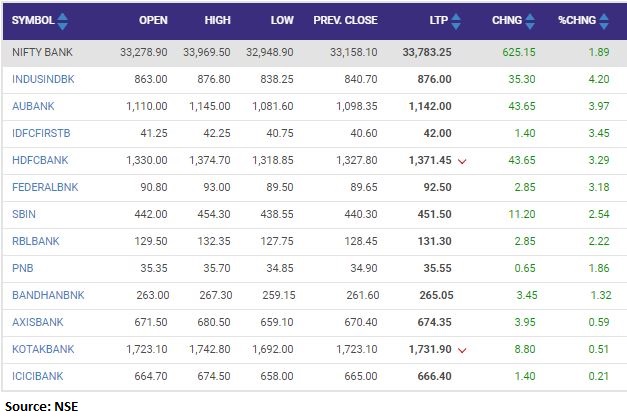

On the technical front, immediate support and resistance in Nifty 50 are 16100 and 16500 respectively. For the Bank Nifty immediate support and resistance are 33200 and 34500 respectively.

Norbert Rücker Head of Economics & Next Generation Research at Julius Baer:

The isolation of Russia leaves a gap on the oil market. The fluidity of the situation and the uncertainty of how supply chains will adjust creates extreme nervousness on oil markets and fuels the oil price spike.

The United States’ and the United Kingdom’s ban of Russian oil is not a fundamental game changer. The world is not about to run out of oil. We are witnessing a price crisis rather than a supply crisis. Beyond the near-term uncertainty, we have confidence that the oil price spike follows more or less known patterns. Such sharp up moves usually follow down moves within weeks and months, not years.

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic indices carried forward yesterday’s gains following a clawback in European markets and US futures as smart investors saw value in the current market valuations. Dip buying is noticed in heavyweights, defensives like IT & Pharma, and value buying in Pvt banks.

Oil prices continued to rise after the US banned Russian oil imports. The domestic market is also reacting positively to exit polls and in anticipation of in-line state election results.

In the near term, the domestic market will trade as per the positive or negative surprise in the state election results and global trend.

S Ranganathan, Head of Research at LKP securities:

D-Street Bulls finally held the upper hand today on reports suggesting that the Ukrainian President is no longer pressing for NATO membership.

With Covid behind, short-covering coupled with the exit poll results buoyed the bulls as benchmark indices rose almost 3% in late afternoon trade with major sectoral indices ending in the Green.

Domestic investors who have reposed faith in the GOI policies amidst the turmoil and volatility would be keenly watching the impact of rising oil & commodity prices on inflation and corporate earnings.

Market Close: Benchmark indices ended higher for the second consecutive day on March 9 with Nifty closing above 16,300 mark.

At close, the Sensex was up 1,223.24 points or 2.29% at 54,647.33, and the Nifty was up 331.90 points or 2.07% at 16,345.40. About 2585 shares have advanced, 681 shares declined, and 90 shares are unchanged.

Asian Paints, Reliance Industries, Bajaj Finance, M&M and IndusInd Bank were among the top Nifty gainers. On the other hand, Shree Cements, Power Grid Corporation, ONGC, NTPC and Coal India were the biggest losers.

Except metal, all other sectoral indices ended in the green with capital goods, auto and realty indices up 2-3 percent. BSE smallcap and midcap indices gained 2 percent each.

Jefferies view on IndusInd Bank:

According to Jefferies the valuations of IndusInd Bank is looking attractive and reiterated buy rating with target of Rs 1,220 per share.

The independent review of issues around bank’s MFI loans is in-line with management’s indications.

There were certain process gaps, but incremental financial impact may be limited, it added.

IndusInd Bank was quoting at Rs 875.80, up Rs 35.50, or 4.22 percent on the BSE.

Euro rises 0.5% against the dollar ahead of ECB

The euro and other European currencies edged up on Wednesday ahead of this week’s central bank meeting and supported by reports that the European Union was discussing joint bond issuance to finance energy and defence spending.

After touching a 22-month low on Monday sliding to as much as $1.0806, the euro rose 0.5% on the day to $1.0946 helped by a report citing unnamed officials that said the European Union was discussing joint bond issuance.

Sterling rose 0.3% against the dollar to $1.3134.

BSE Realty index added 2 percent led by the Macrotech Developers, Indiabulls Real Estate, Oberoi Realty

CLSA view on Nazara Technologies:

Foreign broking firm CLSA has retained sell on Nazara Technologies with target of Rs 1,615 per share.

Three high courts were scrapping the blanket ban on online gaming. India’s dichotomy between Centre & States’ regulations is a significant sector challenge.

Company’s core business will see a boost with physical eSports events starting Q1FY23.

Nazara Technologies was quoting at Rs 1,743.00, down Rs 44.75, or 2.50 percent on the BSE.

Nifty Bank index rose 1 percent supported by the IndusInd Bank, AU Small Finance Bank, IDFC First Bank

Karma Capital partners with Emkay Global Financial Services:

Karma Capital, a leading equity led portfolio management firm has entered into an agreement with Emkay Global Financial Services for the distribution of its investment solutions. Karma Capital’s entire suite of Alternative Investment Funds (AIF) and Portfolio Management Services (PMS) will now be available to Emkay Global’s customer base.

Emkay Global Financial Services was quoting at Rs 105.50, up Rs 3.35, or 3.28 percent on the BSE.