S. Hariharan, Head- Sales Trading, Emkay Global Financial Services:

Market has rebounded strongly with a turn in the trajectory of foreign investor flows – the last 4 sessions have seen FPI inflows of nearly USD 1 billion. A perceived pivot in the Fed’s tightening cycle and cooling off of crude oil prices have made the macro environment more favourable for India, which has outperformed EM and Asian peers by 6% in the last week.

Banks and Autos have attracted strongest flows while IT has been an under-performer. Going forward, the gap in valuations between Nifty and MSCI Emerging Markets index, as well as the gap between the earnings yield of Nifty vs 10 year G-Sec yield, would be adverse factors and we can expect market returns to be more muted. A pull-back towards the technical support at 200-day moving average at 17000 is possible.

Vinod Nair, Head of Research at Geojit Financial Services:

Amidst the geopolitical storm affecting the global markets, domestic markets moved in-line with its global peers. The global market is also concerned about recessionary risk.

On the domestic front, the major trigger this week will be the RBI’s policy meeting outcome, where the market is largely expecting a 25-50bps rate hike.

Rupee Close:

Indian rupee ended lower by 45 paise at 79.16 per dollar against Tuesday’s close of 78.71.

Indices end higher in the highly volatile session, Nifty around 17,400Market Close: Benchmark indices ended higher in the highly volatile session on August 3 with Nifty around 17,400.

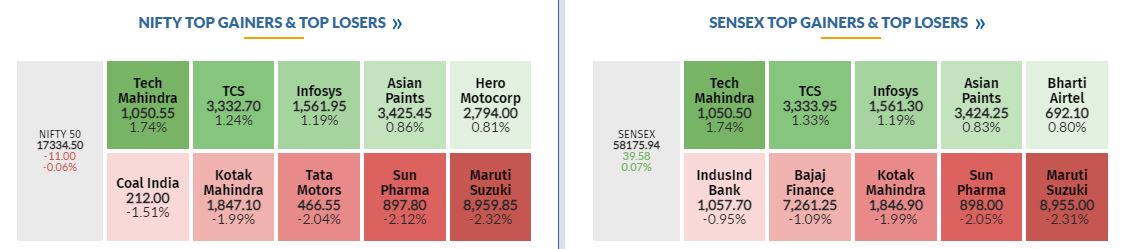

At Close, the Sensex was up 214.17 points or 0.37% at 58,350.53, and the Nifty was up 42.70 points or 0.25% at 17,388.20. About 1337 shares have advanced, 1934 shares declined, and 133 shares are unchanged.

Tech Mahindra, TCS, Infosys, Asian Paints and Titan Company were among the major gainers on the Nifty. The losers included Maruti Suzuki, Sun Pharma, Tata Motors, Kotak Mahindra Bank and Coal India.

Except Information Technology all other sectoral indices ended in the red.

The BSE midcap index fell 0.6 percent and the smallcap index was down 0.28 percent.

CLSA View On Godrej Properties

Brokerage hpuse CLSA has kept underperform rating on Godrej Properties and cut target price to Rs 1,523 per share. The low collections and steady spend drag the cash flows.

The maintain presales guidance of Rs 10,000 crore plus for FY23. CLSA remain cautious & cut margin estimates, reported CNBC-TV18.

Godrej Properties was quoting at Rs 1,421.85, down Rs 41.30, or 2.82 percent on the BSE.

BSE Realty index shed 0.6 percent dragged by the Indiabulls Real Estate, Sobha, Godrej Properties

Credit Suisse View On Escorts

Foreign research firm Credit Suisse has kept underperform rating on Escorts with a target at Rs 1,440 per share.

The peaking cycle, high competitive intensity and full valuations keep us on sidelines, while near-term drivers of tractor demand appear supportive.

The tractor cycle remains near its peak with high share of replacement demand. The high valuations with company facing twin challenges of margin & market share.

Credit Suisse trim FY23/24 estimates by 17%/7%, reported CNBC-TV18.

BSE Capital Goods index fell nearly 1 percent dragged by the THermax, Siemens, Bharat Forge

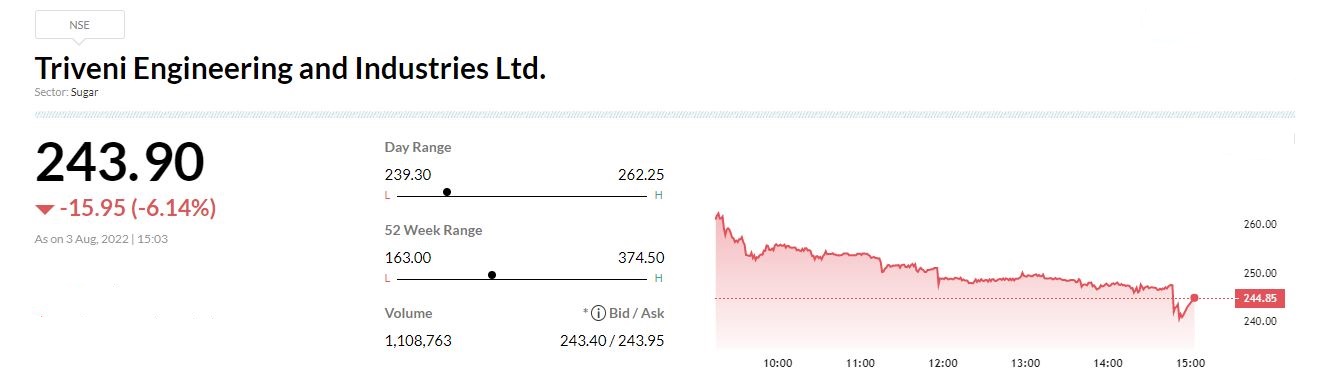

Triveni Engineering and Industries Q1 results: Triveni Engineering and Industries has posted 28 percent fall in its Q1 net profit at Rs 66.4 crore against Rs 92.3 crore and revenue was up 22.5% at Rs 1,361.5 crore versus Rs 1,111.5 crore, YoY.

Market at 3 PMBenchmark indices were trading flat amid volatility.The Sensex was up 80.83 points or 0.14% at 58217.19, and the Nifty was up 1.60 points or 0.01% at 17347.10. About 1159 shares have advanced, 1969 shares declined, and 104 shares are unchanged.

Government to build more green expressways: Transport minister Nitin Gadkari

Replying to supplementaries during the Question Hour, the minister said there is no shortage of funds with the National Highways Authority of India (NHAI) which has AA rating and is financially very…

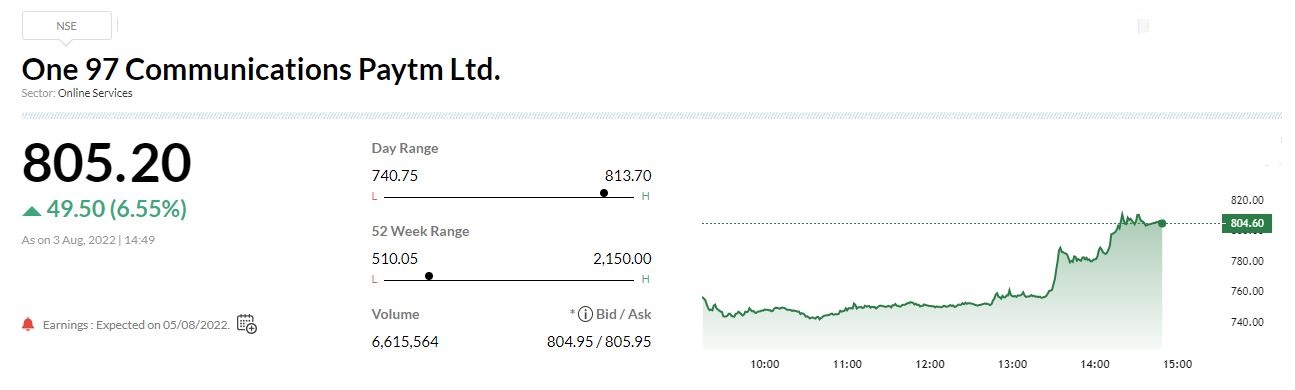

Axis Capital View on One 97 Communications (Paytm):We value Paytm using DCF (with explicit adjustment for ESOP cost), which gives us a target price of Rs 940. We assume a WACC of 13.0% and terminal growth rate of 5% at the end of 10 years. Key risks are adverse regulatory changes for fintechs on payments and lending, increase in competitive intensity, and inability to moderate customer acquisition costs.