Follow our LIVE blog for the latest updates on the Russia-Ukraine and its impact

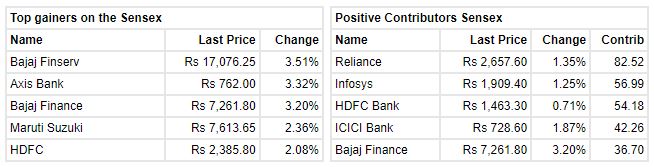

Sensex has surged over 600 points, top contributors included heavyweight Reliance Industries, ICICI Bank, Infosys and Axis Bank

Nifty hit intraday high, touching the 17,500 mark led by Tata Consumer, Bajaj Finserv and Axis Bank

Veranda Learning Solutions IPO updates:

The initial public offering (IPO) of Veranda Learning Solutions had been subscribed 86 percent, garnering bids for 1 crore equity shares against an offer size of 1.17 crore equity shares, by the morning of March 30, the second day of bidding.

Retail investors who bid 4.95 times their allotted quota continued to show interest in the public issue. The portion set aside for non-institutional investors has been subscribed 90 percent and that of qualified institutional buyers 5 percent.

Market Update at 11 AM: Sensex is up 631.81 points or 1.09% at 58575.46, and the Nifty jumped 164.70 points or 0.95% at 17490.

Hariom Pipe Industries IPO subscribed 14% on first day

The initial public offering of Hyderabad-based Hariom Pipe Industries received bids for 11.91 lakh shares against an IPO size of 85 lakh shares, getting subscribed 14 percent on March 30, the first day of bidding.

Retail investors bid for 40 percent of their quota, while qualified institutional buyers and non-institutional investors are yet to bid.

Up to 30 percent of the issue is for qualified institutional buyers, and up to 35 percent each is reserved for non-institutional and retail investors.

Likhita Chepa, Senior Research Analyst, Capitalvia Global Research:

The market giants led the Indian benchmarks higher on Tuesday. Today Indian equity markets have opened with a gap-up amid global market advances.

Crude oil prices have dropped, and investors have cheered signs of progress in Russia-Ukraine talks. Traders may also find comfort in Finance Minister Nirmala Sitharaman’s declaration that India’s rapid economic rebound following COVID-19, as well as Budget policies, will help to maintain growth momentum in the years ahead.

The stock market in the United States ended the day higher on Tuesday, as investors cheered upbeat economic statistics and progress in peace talks in Ukraine. In early trade on Wednesday, Asian markets were generally higher as global stocks climbed on hopes that peace talks over Ukraine are progressing.

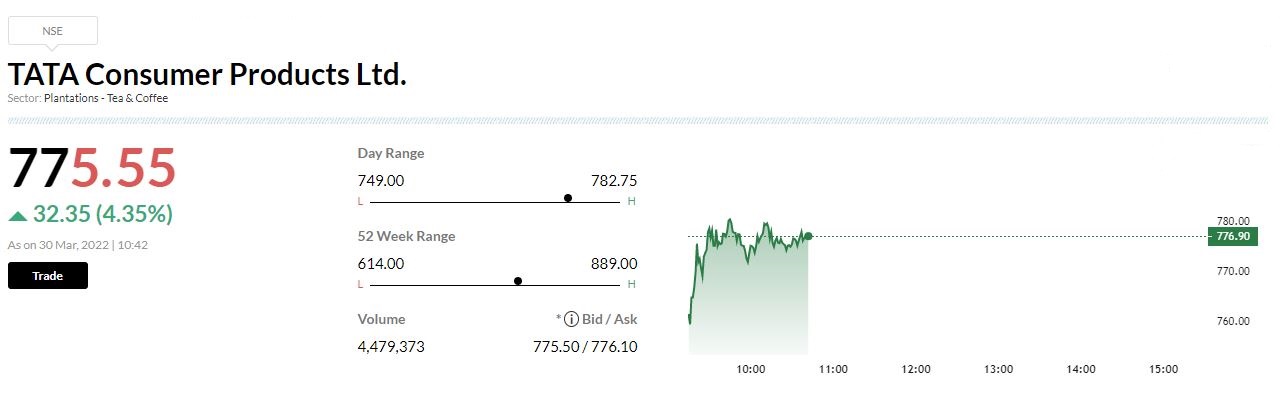

Buzzing:Tata Consumer Products’ share price added 5 percent in the morning trade on March 30 after the company announced a merger plan and acquisition of stake in a UK subsidiary.Tata Consumer Products (TCPL) approved the Composite Scheme of Arrangement amongst the company, Tata Coffee and TCPL Beverages & Foods and their respective shareholders and creditors.The plantation business of Tata Coffee Ltd (TCL) will be demerged into TCPL’s wholly-owned arm TCPL Beverages & Foods Ltd (TBFL), the remaining business of TCL, consisting of its extraction and branded coffee business, will be merged with TCPL, the company said in a statement.Tata Consumer Products board also approved the acquisition of 2,38,71,793 ordinary shares of £ 1 each representing 10.15 percent paid-up share capital of Tata Consumer Products UK Group Limited, United Kingdom, an overseas subsidiary of the company from Tata Enterprises (Overseas) AG, Zug, Switzerland, a minority shareholder of TCP UK, for a total purchase consideration of Rs 570.80 crore.

Rupee Opens:

Indian rupee opened 35 paise higher at 75.64 per dollar on Wednesday against previous close of 75.99.

Rupee is expected to appreciate today amid weak dollar and softening of crude oil prices. Further, rupee may gain strength on rise in risk appetite in the global markets. Market sentiments improved on hopes of de-escalation in Ukraine-Russia conflict, said ICICI Direct.

Talks were described by both nations as constructive. Meanwhile, investors will remain cautious ahead of job data from US. USDINR (April) is expected to trade in a range of 75.75.25-76.20, it added.

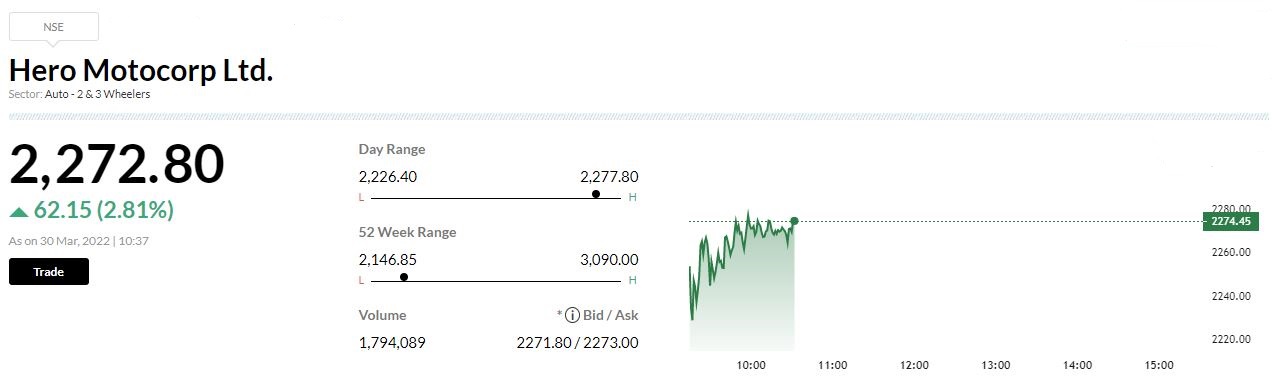

BuzzingHero MotoCorp share remained in focus today after company clarified that the allegations made in the press report are not borne out of any document that have been served on us or our internal documents. Therefore, we categorically deny the speculative press reports, Hero MotoCorp said in its statement.We wish to clarify that officials from the Income Tax department visited our offices in the previous week. The Company has provided all support and cooperation, necessary documents and data to the authorities and will continue to do so if required.In an another press note the company said that it will make an upward revision in the ex-showroom prices of its motorcycles and scooters, with effect from April 5, 2022

BSE Realty index rose 1 percent supported by the Macrotech Developers, Indiabulls Real Estate, Brigade Enterprises

Motilal Oswal view on Tata Consumer Products merger plan

The combined entity will house the entire bouquet of strong consumer brands such as Tata Tea, Tetley, Eight O’clock, Tata Coffee, Tata Salt and Tata Sampann among others creating an operational synergy in terms of common customers and sales & supply chain opportunities through enhanced geographical reach.

As per management; with the consolidation of ownership interests in the international branded business, cost benefits, higher operating and other efficiencies is expected to kick in generating an incremental EPS of ~5-10% going forward.

We expect a sales/EBITDA/PAT CAGR of 9%/17%/23% over FY21-24E, respectively. Factoring the increase in outstanding share by 3.4% in FY24 due to restructuring and minority income adjustment; we increase our EPS estimate by ~3%.

Maintain buy rating on the stock with SOTP based target price of Rs 900.