Follow our LIVE blog for the latest updates on RBI Policy

Nifty Realty up half a percent; stocks trade mixed

Market shrugs off nervousness as RBI sticks to predictions; rate sensitive stocks gain

Market shrugs off nervousness as RBI sticks to predictions; rate sensitive stocks gain” title=”

Market shrugs off nervousness as RBI sticks to predictions; rate sensitive stocks gain” title=”Market shrugs off nervousness as RBI sticks to predictions; rate sensitive stocks gain

“>

The nervousness shown by the market over last seven sessions when both Nifty and Sensex closed in the red seems to have disappeared as RBI Governor Shaktikanta Das progressed in his speech

Ramani Sastri – Chairman & MD, Sterling Developers

The rate hike may impact the real estate sentiment when buyers are likely to invest in their dream homes during the ongoing festive season. Home loan interest rates may increase now, leading to short-term turbulence on overall housing demand. The recent consecutive repo rate hikes had already added to buyers’ overall acquisition cost. With gradually increasing loan rates, homebuyers’ apprehension could set in quickly and they might adopt the wait-and-watch sentiment. The real estate sector had started seeing gradual recovery across key property markets, driven primarily by end-users and this decision will have adverse impact for the interest rate-sensitive sector. Subsequent rate hikes will also mean a deterioration of affordability as low interest rates have been the biggest factor in the resurgence for real estate demand in the last few years.

Nilesh Shah, Group President & MD, Kotak Mahindra Asset Management Company

The RBI gave a “Mai Hoon Na” policy doing a fine tight rope walking between Inflation, Growth and Stability. The RBI is batting on a difficult pitch against a hostile bowling. Rapidly deteriorating global situation, drawdown of systematic liquidity and FX reserves, inflationary pressure and Growth concern are testing the RBI. The RBI has so far batted with few misses. Most important thing is that they haven’t lost the wicket and kept score board moving. The RBI has been proactive and data driven to deal with rapidly evolving situation. They have assured the market that they are in safe hands in the global storm.

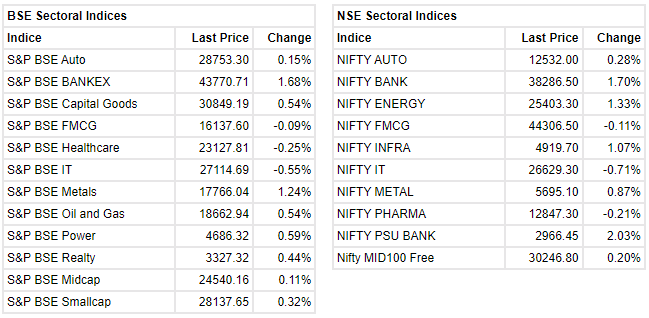

Markets at 11 AMThe Sensex is up 485.35 points or 0.86 percent at 56,895.31. Nifty is up 133.10 points or 0.79 percent at 16,951.20. About 1696 shares have advanced, 1238 shares declined, and 122 shares are unchanged.

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

The dominant theme in economic and market discussions these days is India’s resilience and outperformance in a weakening global economy and bearish equity markets. The RBI governor’s comments today is a reaffirmation of this ‘India resilient’ theme. It was this positive commentary on India’s growth impulses and projection of 7% GDP growth with 6.7% inflation for FY 23 that has come as a positive even while the policy announcements relating to rates were on totally expected lines. The Governor’s confident statement that CAD can be financed comfortably even with crude at $100 for the rest of the year is reassuring. In brief, the positive commentary is positive for markets.

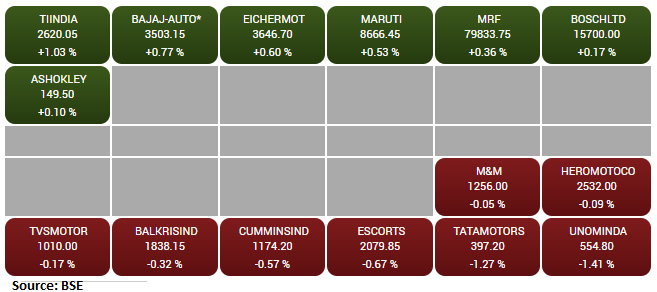

S&P BSE Auto Index trades flat; Maruti Suzuki and Eicher Motors gain

Madhavi Arora, Lead Economist, Emkay Global Financial Services

The MPC delivered 50 bps hike in line with expectations. Clearly, the fast-evolving world order and consistent repricing of Fed’s outsized hikes are strong-arming the EMs. This painful adjustment has not spared the RBI either, which realised the net cost of a supposed soft signalling via shallow hike could be higher than a larger hike of 50 bps. This exposes the instability inherent with the classic EM central bank trilemma: one cannot have a stable currency, unfettered capital flows, and independent monetary policy all at the same time.

This conscious front-loading could give them some breather next year on shallow hikes ahead. With inflation likely to be largely in line with RBI’s estimates, this week’s 50 bps hike will make the ex-post forward real repo rate positive, albeit still lower than the RBI’s estimated real neutral rate of 0.8-1%. At this point, we still think that the RBI would not go too restrictive and terminal rate could hover near the estimated real rates, implying not more than 100 bps hikes ahead, including today’s decision. However, the extent of global disruption will remain key to the RBI’s reaction function ahead.

Central bank lowers real GDP growth estimate for FY23 to 7% from 7.2%

Central bank lowers real GDP growth estimate for FY23 to 7% from 7.2%” title=”

Central bank lowers real GDP growth estimate for FY23 to 7% from 7.2%” title=”Central bank lowers real GDP growth estimate for FY23 to 7% from 7.2%

“>

The central banker estimated growth for the second quarter of FY23 at 6.3 percent (versus 6.2 per cent earlier)

Ravindra Rao, CMT, EPAT, VP- Head Commodity Research at Kotak Securities:

COMEX gold is trading 0.2% higher in line with softer US Dollar Index and steady US treasury yields. Gold had slipped to more than two-year lows earlier in the week when dollar had fresh two decade high near 114.5 pushing gold prices towards $1600/oz.

However, sharp dollar weakness in the last two sessions has pushed the bullion higher. We expect gold prices to trade sideways to higher as markets remain cautious ahead of key inflation figures from the Eurozone.

RBI slashes India’s real GDP growth rate from 7.2 percent to 7 percent for FY23. Inflation projection retained at 6.7 percent for FY23