HDFC all set to merge with HDFC Bank

Regulatory changes reduces barriers for a merger, says Deepak Parekh

The regulatory changes over last 3 years have reduced barriers for a merger, said Deepak Parekh Chairman of Housing Development Finance Corporation.

The NPA classification is now the same for NBFC/HFCs & banks and upper layer of NBFCs will have tighter regulations, similar to banks, he added.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The merger of HDFC with HDFC Bank is an unprecedented mega-merger which will benefit all stakeholders. The shareholders of both entities stand to benefit substantially as already reflected by the sharp up moves in their stock prices. For shareholders, this is far better than a buyback at higher prices. This mega-merger will correct the recent underperformance of the HDFC twins. The stock prices of HDFC twins are likely to remain firm even after this morning’s sharp spike. From the valuation perspective, the HDFC twins are even now only attractively priced in a highly valued market. FPI’s strategy of sustained selling in HDFC twins has been proved to be a short-sighted decision.

The merged entity will gain from the synergies of the merger. The mortgage business will gain from the low-cost funds of the bank and the bank will gain from HDFC’s competence in mortgage lending. The Indian economy will benefit from larger investment by the merged entity in large infra projects. India will have a large global bank.

Deepak Parekh on HDFC-HDFC Bank Merger

Boards approved all-stock amalgamation of HDFC with HDFC Bank and only after obtaining all regulatory approvals will the merger become effective.

Motilal Oswal view on HDFC

HDFC is our preferred pick in the Housing Finance space. We like its ability to gain profitable market share despite significant competitive pressures.

The real estate market has continued to be buoyant in 4QFY22, and even non-individual disbursements have started to pick-up that will exhibit an improved momentum in overall disbursement growth. Maintain Buy.

Housing Development Finance Corporation was quoting at Rs 2,724.45, up Rs 273.50, or 11.16 percent.

Santosh Meena, Head of Research, Swastika Investmart on the HDFC merger with HDFC Bank

HDFC on Monday announced that it will merge with HDFC Bank, with a share merger ratio of 42 shares of HDFC Bank to 25 shares of HDFC. The proposed transaction will enable HDFC Bank to build its housing loan portfolio and enhance its existing customer base. Post the above scheme, HDFC Bank will be 100 percent owned by public shareholders and existing shareholders of HDFC will own 41 percent of HDFC Bank.

For HDFC Ltd. the biggest gain will be access to well-diversified low-cost funding and a huge customer base of HDFC Bank Ltd. Earlier NBFC’S used to enjoy regulatory arbitrage vis-à-vis banks, but the regulatory authorities have harmonized the same, thus making this merger necessary and creating a competitive advantage over its peers.

The proposed merger will enable HDFC Bank to build its housing loan portfolio. The housing loan market is at the cusp of a strong up-cycle along with tailwinds for the real estate sector, and it provides a steady secured asset class with very attractive risk-adjusted returns. This will increase the balance sheet size of the merged entity enabling it to underwrite large ticket size loans.

Overall this is a marriage made in heaven, creating increased scale, comprehensive product offering, balance sheet resiliency, and the ability to drive synergies across revenue opportunities, operating efficiencies, and underwriting efficiencies, hence benefiting stakeholders of both the companies.

Top 10 trading ideas for April series as bulls start journey towards 18,000

Tata Communications has consolidated and maintained a base near Rs 1,130 levels and has picked up momentum with a bullish candle pattern to imply strength. It has potential to carry on with positive…

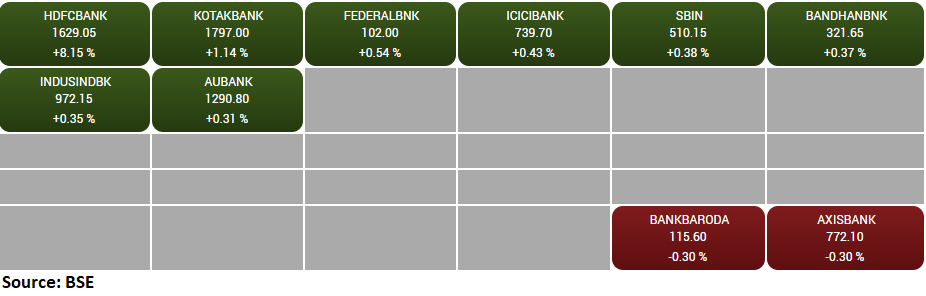

BSE Bankex index added 2 percent supported by the HDFC Bank, Kotak Mahindra Bank, Federal Bank

Ajit Kabi, Banking Analyst at LKP Securities on HDFC Bank and HDFC Ltd merger:

We expect the technological platform to be well synchronized and shall enable the bank to build a larger housing loan portfolio. The proportion of unsecured loan will be narrowed down and it will drag down the risk weight, hence improvement in the capital buffer.

Despite the larger housing book, the NIMs are likely to stay stable as the bank’s aggressive approach to build a low-cost CASA deposit. The valuation (4x) is still attractive after double-digit single day growth. We believe it’s the win-win situation for both shareholders

HDFC-HDFC Bank Merger | We believe that the housing finance business is poised to grow in leaps and bounds, says HDFC Chairman, Deepak Parekh#HDFC #HDFCBank pic.twitter.com/cAMOBgDaAO

— CNBC-TV18 (@CNBCTV18Live) April 4, 2022

D Subbarao, former governor of Reserve Bank of India on HDFC-HDFC Bank merger: “I think it’s a good thing for the Indian banking system. India wants to upsize its banks to a global scale and it will be a good thing for Indian banking, especially private sector banks,”: D Subbarao, former governor of Reserve Bank of India on HDFC-HDFC Bank merger, according to a Bloomberg report.

Samir Bahl, CEO, Investment Banking at Anand Rathi Advisors on HDFC merger:

This is India’s largest and most transformational mergers in the Indian financial services sector. With this merger HDFC bank gets an unparalleled advantage through the mortgage portfolio providing it a quantum leap in distribution to semi urban and rural areas with a huge opportunity to cross sell bank products to a very very sticky client base. The combined entity will be able to extract substantial synergy benefits which abode well for all stakeholders and shareholder. We are already seeing that in the market reaction to this unprecedented announcement today.