Follow our LIVE blog for the latest updates on Assembly elections results for five states

Mahesh Kumar, EVP & Head Capital & Commodities Market (Abans Group):

Natural gas prices corrected from recent high of $5.184 registered on Monday and now trading near $4.603 marginally up from yesterday’s low of $4.451

US temperatures are likely to decrease heating demand for natural gas. As per weather agency Atmospheric G2, above-normal temperatures are expected across most of the US from March 14-18, and spring-like warmth will continue across most of the central and eastern parts of the U.S. from March 19-23. It is negative for natural gas prices.

Natural gas prices are likely to get fresh direction from today’s weekly inventory report. The consensus is for inventories to fall by 121 bcf. Last EIA report showed that US natural gas inventories fell by 139 bcf to 1,643 bcf in the week ended Feb 25 against expectations of drop by 141 bcf. Natural gas Inventories in US remain tight and are down -10.9% y/y and -13.4% below their 5-year average.

CME Natural gas prices are likely to remain negative on change in weather forecast. It may find immediate resistance around $4.793-$5.26 meanwhile immediate support level could be seen around $4.55-$4.329.

BSE Smallcap indices up 1 percent supported by the Take Solutions, EPL, TTK Prestige, IOL Chemicals

Market at 3 PMBenchmark indices erased intraday gains but still trading higher with Nifty above 16500 level.The Sensex was up 698.06 points or 1.28% at 55345.39, and the Nifty was up 210.80 points or 1.29% at 16556.20. About 2346 shares have advanced, 813 shares declined, and 88 shares are unchanged.

Ugro Capital to consider fund raising on March 14

The meeting of the Investment and Borrowing Committee of the Board of Directors of Ugro Capital is scheduled to be held on Monday, 14th March, 2022, to consider and approve raising of funds by way of issuance of Non-Convertible Debentures on private placement basis.

Ugro Capital was quoting at Rs 175.75, up Rs 1.80, or 1.03 percent on the BSE.

Diligent Industries board recommends sub-division of shares

Diligent Industries board has recommended the split / sub-division of shares of the company from face value of Rs 5 each to face value of Re 1 each, subject to the approval of members of the company.

Diligent Industries touched a 52-week high of Rs 61.35 and Diligent Industries was quoting at Rs 61.30, up Rs 2.85, or 4.88 percent on the BSE.

Tata Power signs MoU with Enviro to set up EV charging points in Gurugram

Tata Power collaborated with Enviro – the facility management wing of the NCR-based real estate developer Vatika Group to install 59 EV charging points at its properties across Gurugram, Haryana. The EV chargers will be installed at 18 locations across the properties of Vatika Group in Gurugram. These chargers will be made available as Public Charging Stations and Semi-Public based on the nature of the premises. Tata Power was trading at Rs 232.45, up Rs 3.20, or 1.40 percent. It has touched an intraday high of Rs 235.95 and an intraday low of Rs 229.90.

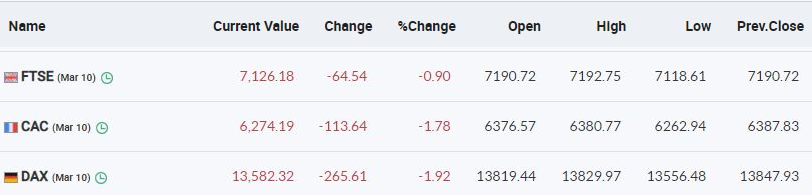

European Markets Updates

Santosh Meena, Head of Research, Swastika Investmart:

Indian market witnessed a strong recovery after a brutal fall thanks to some positive news flows on the Russia-Ukraine standoff that to rally in global equity markets and cool off in commodity prices. The outcome of state election results is also acting as a tailwind for the Indian equity market however it has the impact of only one day and the main focus of the market will remain on the Russia-Ukraine issue because there are still uncertainties. US inflations numbers will be announced today which is likely to come at a five-decade high and it will act as a critical factor in the upcoming US Fed meeting. Markets are likely to remain volatile till the Fed meeting. Technically, Nifty witnessed a smart pullback from the 15700 level however 16800-17000 is a critical supply area that Nifty has to take out for any trend reversal otherwise there is a risk of sell-off after this pullback. On the downside, 16500-16400 is an immediate support zone while 16000/15500 is the next critical support level. If Nifty manages to take out the 17000 level then the bulls will be back in the game where 17300/17500 are the next resistance levels.

Short-term traders should watch market behavior in the 16800-17000 zone then trade accordingly while long-term investors should continue to accumulate good quality stocks. Our top preferred sectors are capital goods, infrastructure, real estate, and financials however rising commodity prices are a major challenge in the near term. IT stocks may continue to do well after a recent correction while some private banks like HDFC Bank, Kotak Bank, and ICICI Bank are looking attractive after a recent fall.

Market Update at 2 PM: Sensex is up 592.58 points or 1.08% at 55239.91, and the Nifty gained 177.10 points or 1.08% at 16522.50. Hindustan Unilever, Grasim Industries and Tata Motors are the top gainers while Coforge, Tata Motors and ICICI Bank are the most active stocks.

Among the sectors, the realty index added over 2 percent while the banking and auto index gained over a percent each.

Nasdaq-listed Ebix Inc’s Indian subsidiary files for IPO to raise Rs 6,000 crore

Ebixcash Ltd, Indian subsidiary of Nasdaq-listed Ebix Inc, has filed draft papers for an initial public offering (IPO) to raise Rs 6,000 crore through a fresh issue of shares. The firm may consider a pre-IPO placement of as much as Rs 1,200 crore, the draft papers said.

The proceeds from the IPO worth Rs 1,035.03 crore will be used for funding working capital requirements of Ebix Travels Pvt Ltd and EbixCash World Money Ltd. Proceeds worth Rs 2,747.57 crore will be used for purchase of outstanding compulsorily convertible debentures from Ebix Mauritius. Motilal Oswal Investment Advisors, Equirus Capital, ICICI Securities, SBI Capital Markets and Yes Securities are the lead managers to the issue.

BSE Capital Goods index rose 1 percent supported by the Sona BLW Precision Forgings, V-Guard Industries, Thermax