Check out all the latest developments on the Russia-Ukraine conflict

Market Update at 11 AM: Sensex is down 886.66 points or 1.58% at 55360.62, and the Nifty shed 219.40 points or 1.31% at 16574.50.

Beneath rouble’s rubble, rupee gets a collateral damage

The rupee has depreciated more than 2 percent since Russia invaded Ukraine on February 24 and the Indian currency is likely to continue to be under pressure due to the ongoing geopolitical conflict.

Last week, more sanctions were imposed on Russia and its rouble has already sunk almost 20 percent against the dollar, which made the country’s central bank hike policy rates sharply. The conflict has triggered a widespread rush to the safety of the dollar and that has meant most emerging market currencies have depreciated.

The rupee too is in the same camp. During crises, foreign funds typically tend to avoid investing in most emerging market economies as a block even though some countries may be more resilient than others. Indeed, the rupee’s weakness stems from the broader and democratic rise of the dollar against most currencies. Read more

Ravi Singh-Vice President and Head of Research at ShareIndia

The ongoing tension between Russia and Ukraine is riding high for gold and crude oil prices. The US and EU have levied sanctions on Russia’s biggest banks and its elite, frozen the assets of the country’s Central Bank located outside the country, and excluded its financial institutions from the SWIFT bank messaging system but have largely allowed its oil and natural gas to continue to flow freely to the rest of the world. Gold may continue to be in bullish trend till the situation stabilizes. Buy zone near Rs 51650 for target of Rs 51900. Sell zone below Rs 51500 for target of Rs 51300.

India IHS Markit February manufacturing PMI at 54.9 against 54 (MoM)

The Indian manufacturing sector continued to expand in February, with the sector’s manufacturing Purchasing Managers’ Index (PMI) rising to 54.9 from 54 in January. A reading above 50 indicates expansion in activity, while a sub-50 print is a sign of contraction. According to IHS Markit, which released its PMI report on March 2, February saw “strong increases” in new work orders.

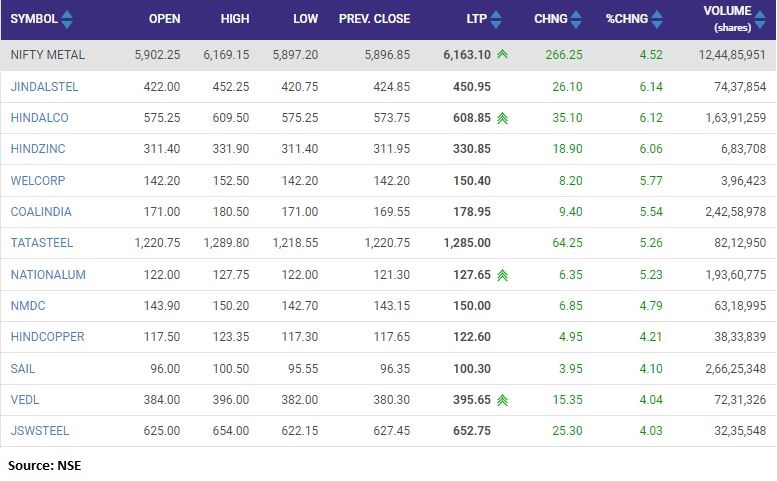

Nifty Metal jumped over 4 percent led by JSPL, Hindalco and Coal India

DB Realty stock hits upper circuit

DB Realty informed the stock exchanges that it has won the title of a land owned by it Mumbai. The matter which was under the review of The Supreme Court through a public interest litigation (PIL), was cleared by the apex court on February 28 in favour of the real estate developer. The court through its order has allowed the subsidiary of the company – Esteem Properties to develop this land in Mumbai.

“By order dated 7 May, 2010, the Hon. High Court at Mumbai had ruled against Esteem. Esteem subsequently preferred an appeal against the Hon. High Court’s Order before the Honourable Supreme Court”, the company said in its filing.

With this decision, the freehold vacant land approximately 22,000 square meters situated in Andheri (East) Mumbai is now available to its subsidiary Esteem Properties for development. The company intends to develop the subject land into a 2 million square feet (leasable area) grade A office space in the next 3 years.

The stock was trading at Rs 99.90, up Rs 4.75, or 4.99 percent. It has touched an intraday high of Rs 99.90 and an intraday low of Rs 99.85. There were pending buy orders of 55,365 shares, with no sellers available.

Tata Motors February auto sales: Total sales up 27% at 73,875 units against 58,366 units (YoY). M&HCV sales up 18% at 10,233 units against 8,664 units (YoY). Total commercial vehicle sales up 9% at 33,894 units against 31,141 units (YoY). Total passenger vehicle sales up 47% at 39,981 units against 27,225 units (YoY). CV exports up 35% at 3,658 units against 2,718 units (YoY). The stock was trading at Rs 452.15, down Rs 2.00, or 0.44 percent. It has touched an intraday high of Rs 453.35 and an intraday low of Rs 446.05.

Gold Prices Today: Yellow metal edges higher, to stay volatile as Russia-Ukraine war escalates

Gold bounced back after a brief correction but is below the recent highs, which shows waning confidence. Volatility will continue unless concreted efforts are made to defuse Russia-Ukraine tensions,…

Anand James – Chief Market Strategist at Geojit Financial Services on Indian stock market:

Both 16420 and 16720, the range extremities lined up for Monday were broken, albeit briefly. A pull back again towards 16580, on either side of which we anticipated Nifty to swing on Monday as well, will confirm our consolidation bias. However, we feel, upside attempts could eventually win, allowing a free run to 17500, but not before 17000-17200-17350 poses significant challenges. Bearish bets will get the first look once inside the 17000-200 region, or on a breakdown below 16340.

Coal India shares rise: Shares of Coal India Ltd rose 6% after the firm reported improvement in output and sales performance for February. The firm produced 64.3 million tonnes of coal in February, registering a growth of nearly 4 percent compared to the year-ago period. On a month-on-month basis, CIL’s average production increased to 2.3 MT per day in February. The stock was trading at Rs 178.35, up Rs 9.70, or 5.75 percent. It has touched an intraday high of Rs 180.50 and an intraday low of Rs 171.05.

Two wheeler stocks skid on weak sales volumes

Shares of Bajaj Auto Ltd lost 5.3%, Eicher Motors Ltd fell 1.2%, and TVS Motors Ltd dropped 2.5%.