Let’s take a look at 5 stocks from Rakesh Jhunjhunwala’s portfolio that got hammered and how they fared on Moneycontrol SWOT analysis.

Investors keenly follow Big Bull Rakesh Jhunjhunwala’s portfolio picks for investment leads. In December 2021 quarter, his portfolio showed holdings in around 35 companies. As markets went into massive corrections, Jhunjhunwala’s portfolio stocks were also not spared, in fact, five stocks have seen deep cuts and fell over 25 percent in 2022 so far. (Data Source: ACE Equity) Please note that this may or may not be an exhaustive list of Jhunjhunwala’s portfolio but only a list of companies in which he holds over 1 percent stake. On the other end, there are also stocks that successfully went against the tide and saw a smart surge – stocks like TV18 Broadcast and National Aluminium Company have gained over 25 percent each, and DB Realty in fact has turned multi-bagger surging over 123 percent in 2022. Coming back to bear dominance, let’s take a look at the five stocks from Jhunjhunwala’s portfolio that got hammered and how they fared on Moneycontrol SWOT analysis.

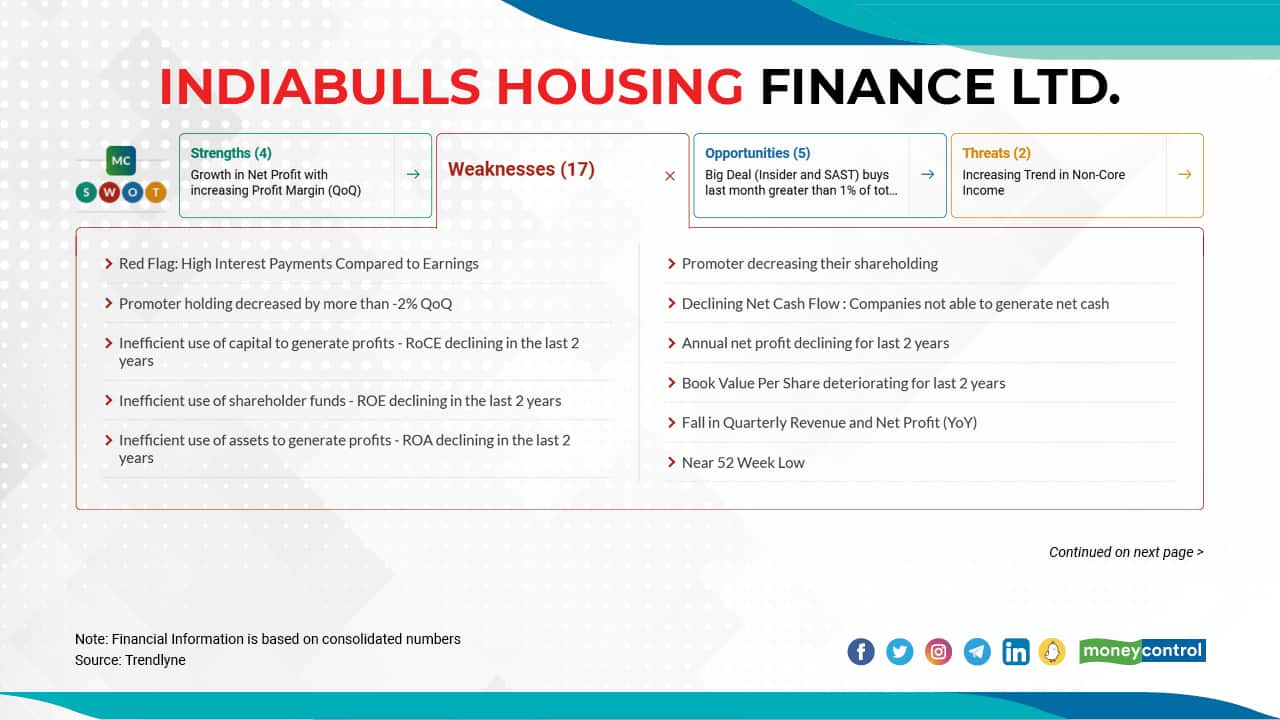

Indiabulls Housing Finance | In 2022 so far, the stock has shed 38 percent to Rs 135.15 as on March 8 from Rs 218 on December 31, 2021. As of December 2021 quarter, Rakesh Jhunjhunwala and Associates’s Portfolio held 1.08 percent stake in the company.

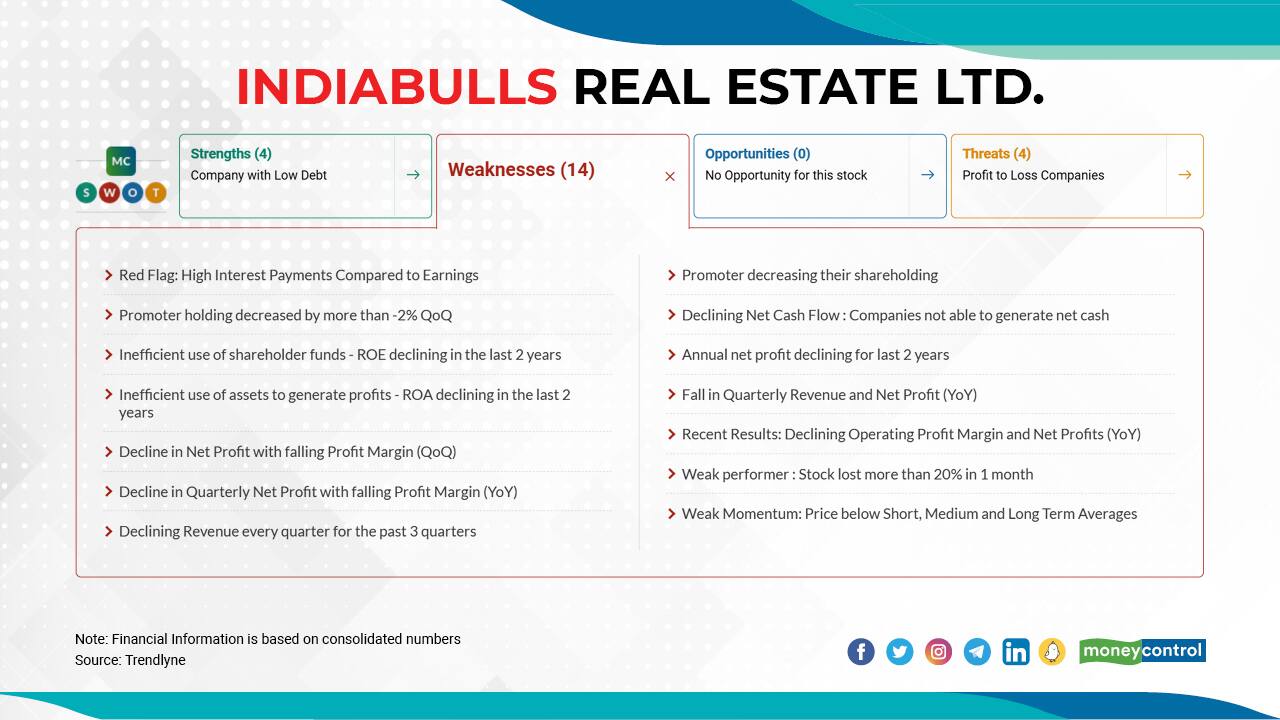

Indiabulls Real Estate | In 2022 so far, the stock fell 35 percent to Rs 101.8 as on March 8 from Rs 157.55 as on December 31, 2021. As of December 2021 quarter, Rakesh Jhunjhunwala and Associates’s Portfolio held 1.10 percent stake in the company.

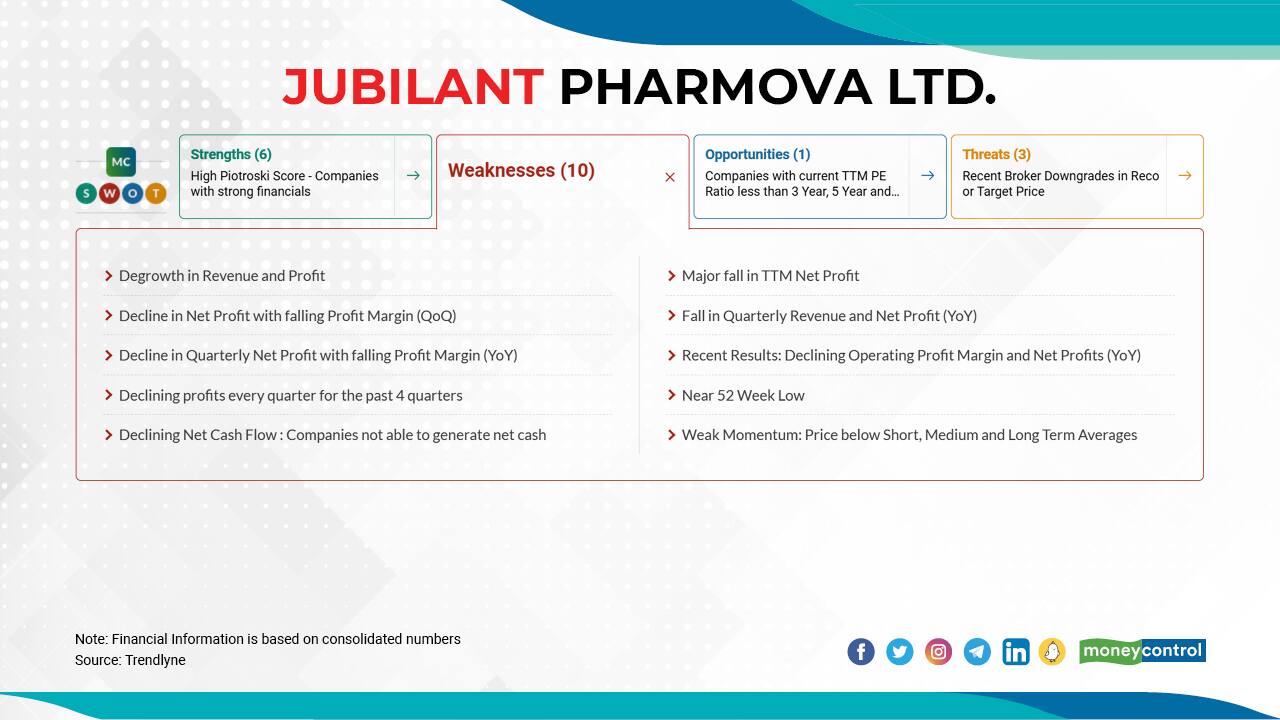

Jubilant Pharmova | In 2022 so far, the stock lost 32 percent to Rs 396.7 as on March 8 from Rs 586.9 as on December 31, 2021. As of December 2021 quarter, Rakesh Jhunjhunwala and Associates’s Portfolio held 6.29 percent stake in the company.

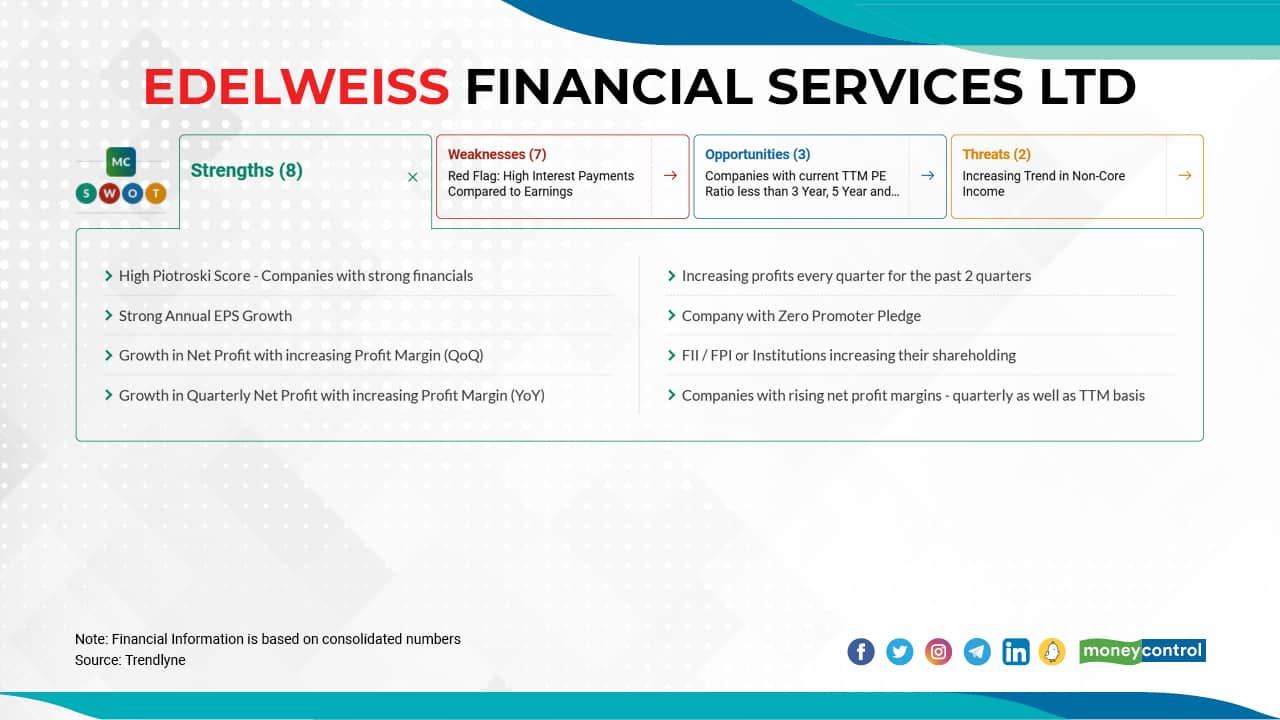

Edelweiss Financial Services | In 2022 so far, the stock declined 28 percent to Rs 52.1 as on March 8 from Rs 71.9 as on December 31, 2021. As of December 2021 quarter, Rakesh Jhunjhunwala and Associates’s Portfolio held 1.60 percent stake in the company.

Jubilant Ingrevia | In 2022 so far, the stock plunged 27 percent to Rs 421 as on March 8 from Rs 574.85 as on December 31, 2021. As of December 2021 quarter, Rakesh Jhunjhunwala and Associates’s Portfolio held 4.72 percent stake in the company.

Ritesh Presswala Research Analyst at Moneycontrol